|

What is

a Tax Deferred Exchange?

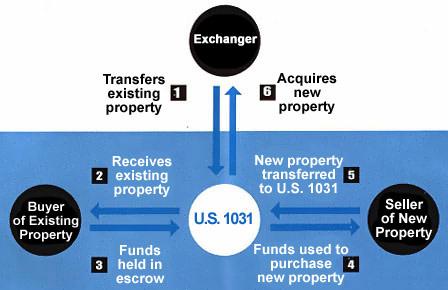

A tax deferred exchange

is simply a method by which a property owner trades one

property for another without having to pay any federal

income taxes on the transaction. In an ordinary sale

transaction, the property owner is taxed on any gain

realized by the sale of the property. But in an exchange,

the tax on the transaction is deferred until some

time in the future, usually when the newly acquired property

is sold.

These exchanges are

sometimes called "tax free exchanges" because the exchange

transaction itself is not taxed.

Tax deferred

exchanges are authorized by Section 1031 of the Internal

Revenue Code. The requirement of Section 1031 and other

sections must be carefully met, but when an exchange is done

properly, the tax on the transaction may be deferred.

In an exchange, a

property owner simply disposes of one property and acquires

another property, rather than the sale of one property and

the purchase of another.

Today, a sale and a

reinvestment in a replacement property are converted into an

exchange by means of an exchange agreement and the services

of a qualified intermediary - a fourth party who helps to

ensure that the exchange is structured properly.

The IRS' new

regulations make exchanging easy, inexpensive and safe.

Internal Revenue Code

(IRC) Section 1031 is one of the last remaining tax

loopholes. It is a powerful tool that allows investors to

exchange any investment property for any other investment

property. For your exchange to be valid, you must follow

specific IRS regulations.

Here is an

abbreviated list of the regulations

1.) The properties

being exchanged must be of a like kind. For example, you may

exchange:

- a house for

another house (or several houses)

- a house for

commercial real estate

- land for rental

property

- a strip mall for

an office building

- any investment

property for any other investment property (as long as it

is not occupied as your primary residence)

2.) You must identify

and close on your replacement property within a specific

period of time

3.) 100% of the

proceeds from your current property must be held by a

Qualified Intermediary and applied toward your replacement

property to get a full tax deferral

4.) Your replacement

property must be of equal or greater value to the property

you have sold to get a full tax deferral

5.) Properties being

exchanged must be used for investment. Personal residences

are not exchangeable

Why use

a 1031 exchange:

To

defer your capital gains tax

To diversify

-

Exchange one property for a larger one.

-

Exchange one property for several properties.

-

Increase depreciation.

To

simplify

-

Exchange several properties for fewer (or one) property.

-

Improve the quality of your property.

-

Decrease management responsibility.

To

relocate

-

Exchange for a property closer to where you live.

-

Exchange to an area with higher appreciation.

Please

consult your tax advisor

Investing -

Interest Rates -

Moving -

Finding Best Agent

-

More Investment Information

-

Refinancing -

Selling Mistakes -

Buying Strategies

-

1031

Exchange -

Agency Information

|